Our Process

The value of a Policy Audit* can be tremendous. From under or poorly-performing policies to savings in annual premiums, increased coverage for the same premium outlay or coverage with improved features/guarantees, often a Policy Audit results in better products or product design relative to your goals and risk tolerance.

The Policy Audit you receive from Metz Insurance will be both thorough and straight-forward, to include:

- Assessment of current coverage details and costs

- Review of current insurer's financial strength

- Identification of guarantees, or lack thereof

- Review of current ownership and beneficiary designations relative to goals

- Identification of income, estate or gift tax issues with respect to current laws and future funding requirements

- Projected future premium obligations and requirements

Life Insurance Review for Professionals

When you purchased your current life insurance policy, you made estimations and assumptions about your future needs, interest rates, planned premiums and other issues. However, your life and needs are constantly changing and evolving, so your coverage should be reviewed by an expert every few years to ensure that it is still in alignment with your goals.

Low interest rates and a volatile investment climate have also caused many life insurance policies sold in the last twenty years to not perform as expected. If left unattended, many of these policies will lapse, and unfortunately, the policyholders, trustees, and professional advisers are often unaware of this.

The trustees who manage irrevocable life insurance trusts are held to a higher fiduciary standard. They carry a greater level of liability with respect to the life insurance asset that ultimately benefits the beneficiary of the trust.

We invite you to click through the links on the left to learn more about our policy review and auditing services. To schedule a consultation with us, please contact us.

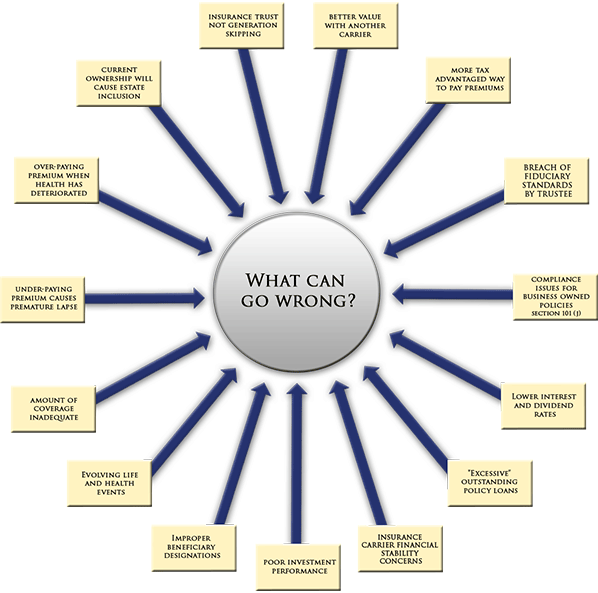

Hazards of Unmanaged Life Insurance

Quick History Lesson

Interest rates on Universal Life policies have been dropping for the last two decades. In fact, back in the 1980’s when some policies were introduced, the rate was almost 12%, considerably higher than it is now. In addition, equity markets perform dynamic returns, not static compounded returns as the illustration suggests, thus impacting policy performance for Variable Life policies. If you purchased a policy based on non-guaranteed projected premiums, poor performance could cause a lapse in coverage unless you pay higher premiums.

When Variable Universal Life hit the market in the late 1980’s, it shifted additional risk to the policyholder. People were eager to obtain these policies because they offered flexibility with premiums and payments, and because they could determine where the policy cash values were invested. While this certainly gave consumers greater upside potential, there was also greater downside potential. When the market was performing well in the 1990’s, illustrations of the expected performance of variable life, universal life, and whole life policies showed much higher rates of return than what is typically seen today. Because of these flawed assumptions, many policies sold in the late 1990’s and early 2000’s are in serious danger of lapsing much earlier than originally projected.

Performance & Rating Factors

The life insurance industry has undergone a transformation over the past two decades. Factors such as lower mortality charges, cost efficiencies, special riders, aggressive underwriting, competitive pressures, and access to capital markets have forced insurance companies to create new life insurance products that may provide a better value than years past.

Factors that may affect the performance of existing permanent life insurance policies:

- Underlying interest rate on cash value

- Premium payment date

- Carrier directed investments (whole & universal life)

- Stock market performance (variable life)

- Actual expense & mortality changes

Cost Efficiencies

Many new market policies now have lower internal mortality costs. Recent mortality tables helped many companies decrease pricing on certain products. Carriers do not typically pass these cost savings onto existing policyholders, so to take advantage of the lower cost, it may be advantageous to purchase a new policy.

Financial Hardship of Carriers

The financial health of many companies has changed over the past decade due to economic conditions. It may be wise to evaluate the financial well-being and stability of the insurance carriers.

Special Riders & Underwriting Programs

There are many newly added coverages and special riders available today. Carriers may also have promotional "shave" programs for certain undesirable health conditions that were not available in the past. The result can sometimes be a reduction in mortality costs.

With the new medical and mortality tables, many illnesses and diseases that were not insurable in the past may be insurable today. Call us to explore.

*No fee or purchase of insurance is required to receive this service.

~001.jpg)

~001.jpg)